Southeast Asia manufacturing countries were both some of the earliest countries affected by COVID-19 and the quickest to return to pre-virus capacity and resume economic growth. While factories are up and running, there remain challenges facing businesses. Travel is still very difficult with a mandatory 14 day observation of hotel isolation, which make short term business visits unlikely.

The impact of COVID-19 in Southeast Asia was first seen in late January to early February, as the outbreak was growing in China. Every aspect of the economy and daily life was impacted, with manufacturing and industrial supply chains being disproportionately disrupted. Prior to COVID-19, Southeast Asia was experiencing unprecedented growth fueled by the growing tensions from US-Sino relations, but the growing fears of a pandemic quickly quelled all future economic prospects with threats of an economic shut down or stoppage in the global supply chain.

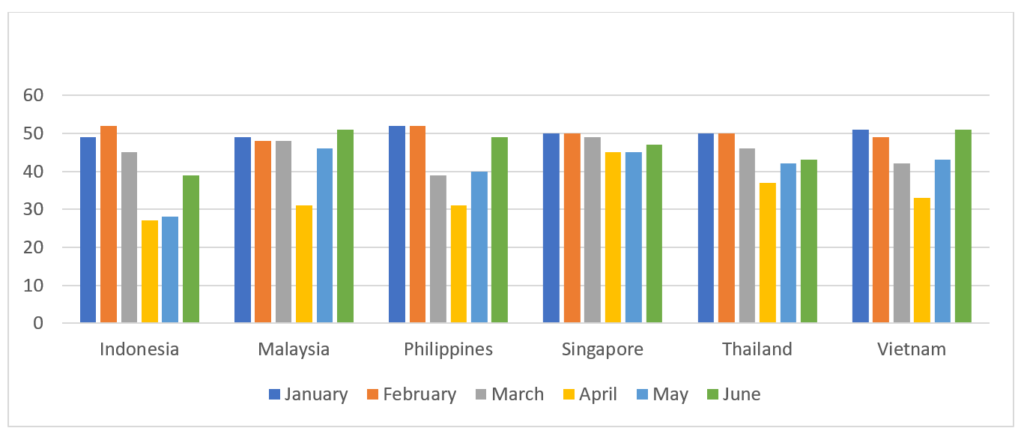

The PMI (Purchasing Managers’ Index) is used as an indicator of the economic health of the manufacturing sector of countries around the world, in which a PMI <50% indicates a contraction and a PMI >50% indicates an expansion. In April, many Southeast Asian countries saw their lowest PMI in years, some falling as low as 27%, compared to 48-53% previously. Following the success of the lockdowns, the PMI jumped significantly back to almost pre-virus levels in the months of May and June with output increasing for the first time since February.

Out of the eleven countries that compose Southeast Asia, Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam are currently the most competitive and competent in the manufacturing space. As these countries began to lift lockdown measures and plan for re-opening of their borders, each observed different performances.

VIETNAM

Vietnam was one of the largest and quickest recovering Southeast Asian countries. Its PMI fully recovered in June, soaring to 51.1% from 42.7% in May, with continued growth as COVID-19 persists to cripple manufacturers and supply chains outside Vietnam. The V shaped recovery was a result of a steady increase in new orders and increased purchasing activities. Vietnam’s unemployment numbers fell at the quickest rate since before the pandemic with backlogs of work decreasing. Amid scarcity of certain materials due to the continued disruption of the global supply chain by COVID, input cost inflation rose for the first time in three months, while selling prices fell for the fifth month.

MALAYSIA

Malaysia also experienced an expedited recovery as lockdown measures were partially lifted in June. Output grew at the fastest rate in the survey history as an increasing number of businesses across the country restarted their operations. PMI surged from 45.6% in May to 51.0% in June. Demand eventually stabilized with new orders index rising. Staffing levels were held stable as some companies moved into retrenchment mode while businesses adjusted their manufacturing forecasts. As COVID-19 impacts the global supply chain, Malaysian manufacturing input costs rose due to stock shortages, transportation costs increased as the world went remote, and economic instability created unfavorable exchange rates. Output prices subsequently increased for the first time this year.

THAILAND

Thailand’s economic recovery was not as swift as Vietnam and Malaysia and still not at pre-COVID levels. Thailand’s PMI only rose 1.9% in June, pointing to six straight months of economic contraction amid the emergency measures and global trade shutdown. Production falling steeply in tandem with declining new sales resulted in a substantial fall in export orders. As a result, firms continued to cut back on purchasing activity and labor capacity. Work backlogs continued to decrease for the fifth month in a row, reflecting a rise in spare manufacturing capacity. Although manufacturing input prices increased, export prices remained the same as firms absorbed the increase in costs to boost sales with their clients.

PHILIPPINES

Philippines PMI increased 9.6% from June to May amid the relaxation of quarantine measures relating to COVID-19, with output increasing for the first time since February. Export orders fell at the slowest rate and new orders continued to decline, leading to a further sharp cut in employment and drops in both purchases and inventories. Input cost inflation soared to a 16 month high as firm saw an increase in supplier prices amid transportation difficulties and higher freight charges.

INDONESIA

As of June, Indonesia experienced its fourth straight month of factory activity contraction even though COVID-19 containment measures are gradually easing. PMI only increased to 39.1% in June. Drops in both output and new orders were smaller than in May, but still a substantial decrease in productivity. Firms continued to reduce employment and purchasing activity. Supply chains remained under pressure, with longer lead times and increased costs and pricing.

SINGAPORE

Economic recovery of Singapore continued to persist as output and new orders in the medical field continued to increase. PMI grew to 46.8% in June from 44.7% in May. Purchase and labor activities remain stable. Input costs rose slightly to reflect the increased import and logistics costs.

FORWARD THINKING

Overall Southeast Asia countries have controlled the pandemic well and most of them are back into pre-pandemic productiveness. Although business travel is still a challenge, factories are trying to overcome these difficulties with creative communication technologies. A larger unknown and fear is how the coronavirus will react as the summer season ends. Thankfully, the majority of Southeast Asia lies on the equator for a predictable outcome. While a second wave is possible, we are hopeful much of Southeast Asia will continue to see improvements in the manufacturing sector.