Contract manufacturing has become an essential aspect of global supply chains, enabling companies to outsource their production processes and capitalize on cost-effectiveness and operational efficiencies. China and Southeast Asia have emerged as key players in the contract manufacturing landscape, offering diverse capabilities and advantages to businesses worldwide. In this article, we will explore and compare the contract manufacturing capabilities of China and various Southeast Asian countries, shedding light on their respective strengths, challenges, and industry trends.

For several decades, China has held the title of the world’s leading contract manufacturing destination. Its unrivaled infrastructure, vast labor pool, and extensive manufacturing ecosystem have attracted multinational corporations seeking cost-effective production solutions at scale. China’s manufacturing prowess spans various industries, including electronics, textiles, automotive, pharmaceuticals, and more.

Advantages of Contract Manufacturing in China:

- Scale and Capacity: China’s manufacturing infrastructure enables large-scale production, making it ideal for high-volume manufacturing requirements.

- Established Supply Chains: The country boasts well-developed supply chains, ensuring easy access to raw materials, components, and equipment.

- Technical Expertise: China has a wealth of technical expertise and skilled labor, particularly in areas such as electronics, enabling complex manufacturing processes and customization.

- Cost Efficiency: Despite rising labor costs, China remains cost-competitive due to economies of scale and efficient production processes.

- Infrastructure: China’s robust transportation network and logistics capabilities facilitate efficient distribution and global shipping.

Challenges and Evolving Landscape in China:

- Labor Costs: Over the years, labor costs in China have risen, diminishing its once-unbeatable cost advantage. However, this has also led to increased automation and adoption of advanced manufacturing technologies.

- USA Tariff Issues: On certain categories of products, there have been tariffs applied from 10% to 25%. Depending on manufacturing and supply chain requirements, some companies need to diversify their less complex products’ manufacturing locations, seeking alternatives within Southeast Asia.

In recent years, Southeast Asian countries have emerged as competitive alternatives to China for a certain type of contract manufacturing. Several nations in the region offer some strategic advantages, including lower labor costs, supportive government policies, geographical proximity to major markets, and trade agreements that enhance market access.

Key Players in Southeast Asia:

-

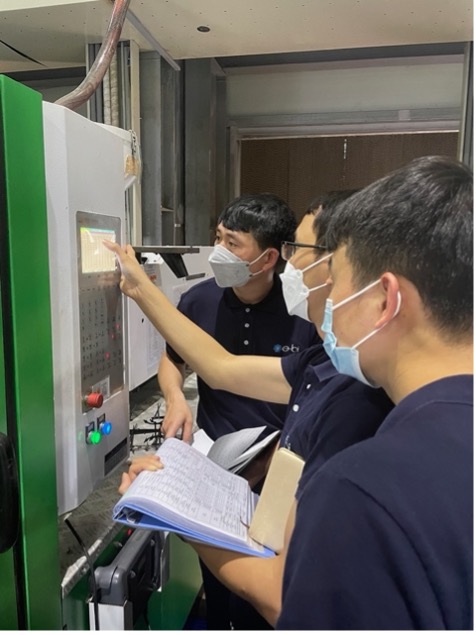

E-BI Hanoi engineering team implementing molding equipment process dial-in in a Vietnam factory Vietnam: Vietnam has become a manufacturing hotspot, attracting investment in electronics, textiles, and automotive industries. It offers a young and skilled labor force, competitive wages, and favorable government policies promoting foreign investment. E-BI Vietnam has been a fast-growing team implementing projects from both the US and other countries. With its close proximity to China, supply chain integration and response speed have been a great advantage made in Vietnam.

- Thailand: Known for its strong automotive industry, Thailand boasts a well-developed manufacturing infrastructure, a skilled workforce, and robust logistics capabilities. However, local manufacturing categories are very limited because of their scale. A sub-tier system is required with an international supply chain.

- Malaysia: Malaysia offers a diverse manufacturing sector, including electronics, chemicals, and medical devices. It benefits from political stability, favorable investment policies, and developed infrastructure. After 40 years of fast development, most industrial sectors are in a stable mode. Its higher cost and shortage of labor have been a challenge for many years.

E-BI precision metalwork engineer, Thomas Yang, working on a NPI process at a Thailand factory. - Indonesia: With a large population and growing consumer market, Indonesia presents opportunities for contract manufacturing across various industries. With its abundant labor resources, Indonesia has its natural advantage for labor-intensive work. However, with thousands of islands, infrastructure development remains a challenge in certain regions.

- Philippines: The Philippines’ contract manufacturing industry focuses on electronics, semiconductors, and consumer goods. It benefits from a young and educated workforce, strong English language proficiency, and preferential trade agreements.

Soft good specialist, Jarry Zhou, working on a pouch manufacturing process control in an Indonesia factory.

When selecting a contract manufacturing destination in China or Southeast Asia, businesses should consider several factors, including labor costs, production capabilities, infrastructure, political stability, logistical advantages, and proximity to target markets.

China has long been the dominant player in the contract manufacturing landscape, offering scale, infrastructure, and technical expertise. However, Southeast Asian countries have steadily gained traction as competitive alternatives, leveraging their advantages such as lower labor costs, supportive government policies, and strategic geographical locations. Depending on product complexity, businesses seeking contract manufacturing solutions must carefully evaluate the unique strengths and challenges of each region to make informed decisions that align with their operational requirements and long-term business strategies.